For any farmer, the harvest is the moment of truth. After a long season of work, you finally see what your toil has yielded. In the corporate fields of Indian agritech, DeHaat just announced its biggest harvest yet: its first-ever profitable year in FY25.

But dig a little deeper past the headline figures, and you’ll find the business is less fertile than it seems.

One of India’s oldest and most prominent agritech startups, DeHaat has spent the past decade building a full-stack model connecting farmers to agri-inputs, advisory services, and market linkages.

And with the profitability, it might also seem that the country’s agritech ecosystem is finally showing some green shoots.

But as we hinted at above, the numbers warrant a closer look.

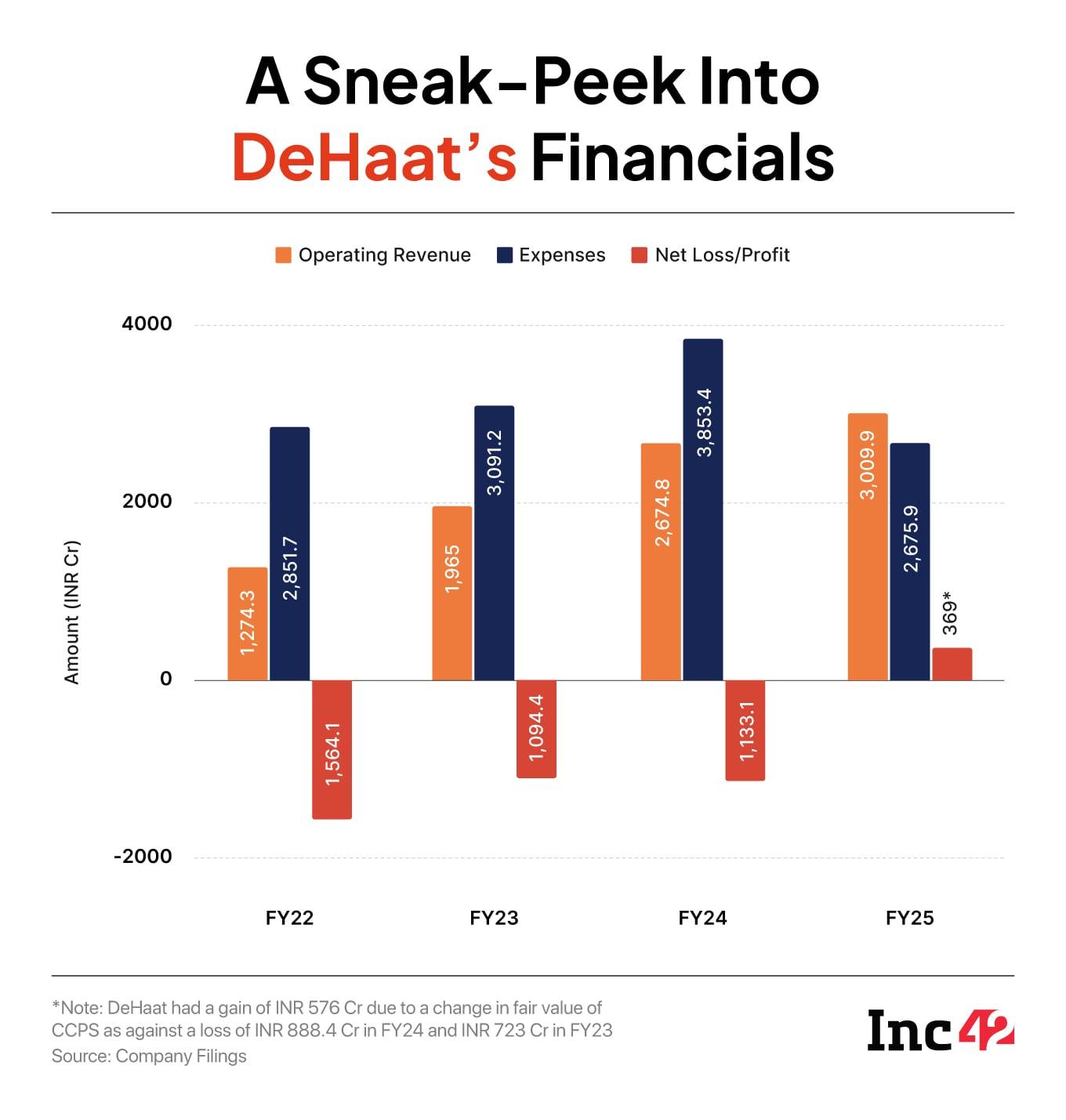

The INR 369 Cr in profit primarily stemmed from non-cash gains, while operationally the company still reported a loss of around INR 207 Cr, on a revenue crossing the INR 3,000 Cr mark.

The startup is yet to turn fully profitable, and now it hopes that FY26 will be its fully profitable year. It claims to have reached an EBITDA breakeven in Q1 FY26

In contrast, in FY24, the Peak XV-backed company posted a 36% YoY growth in revenue to INR 2,720 Cr, with operational loss of almost INR 245 Cr and a net loss of INR 1,113.1 Cr.

At a time when DeHaat is trying to show that it has turned its fundamentals around, one does wonder whether India’s agritech sector is living up to its potential. Profitability in this sector is rarely straightforward and scaling continues to remain difficult.

In fact, if we look at the revenue over the last few years, DeHaat’s projections and the realities of its financials have not matched. Though its Q4 FY25 financials have not been reported separately, its full-year top-line growth in FY25 was merely 11%, its lowest growth rate in the past few years.

Though DeHaat did not respond to Inc42’s queries on the challenges, the startup’s journey mirrors the hurdles of operating in one of the most fragmented and policy-dependent sectors. The Patna-based startup is clearly finding it tricky to balance the top and the bottom line growth.

Low farmer margins, unpredictable yields, diversity, and volatile commodity prices make scaling agritech startups a high cash-burn exercise.

DeHaat does have scale on its side. Does that really give it an edge over the competitors who are also similarly struggling to reach profits?

Having raised more than $247 Mn and with seven acquisitions in six years, DeHaat is the poster child of the agritech ecosystem in India. It claims to be working with over 13 Mn farmers and 18,000+ rural entrepreneurs across 11 Indian states.

Founded by Abhishek Dokania, Adarsh Srivastava, Amrendra Singh, Shashank Kumar and Shyam Sundar Singh, DeHaat is a market linkage platform. With more than 15,000 micro-entrepreneurs on board, DeHaat claims to have reached 1.2 Lakh Indian villages.

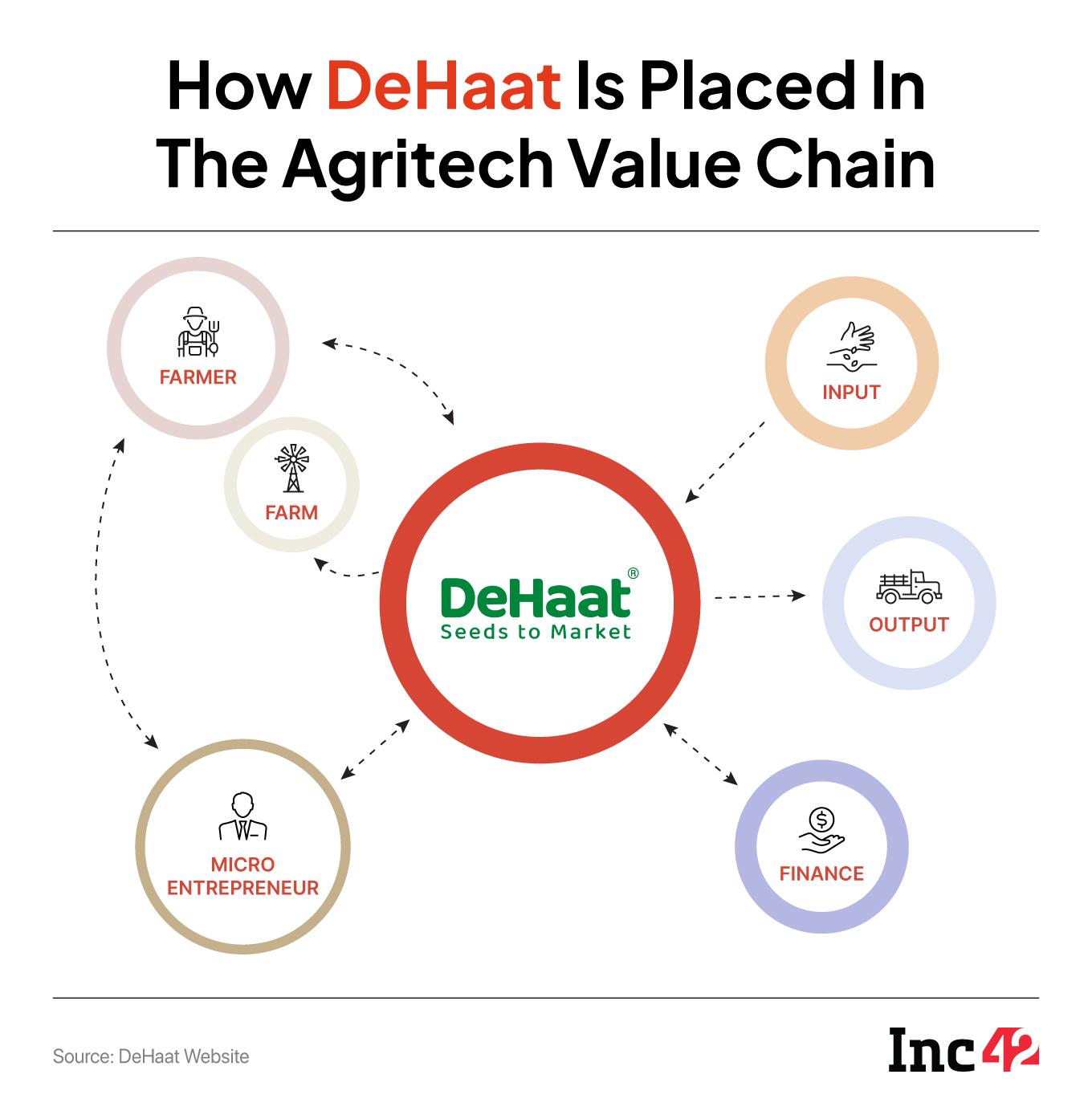

On the input side, it supplies farmers with seeds, fertilisers, and crop protection products and advisory to help increase yield. On the output side, which functions via Farm Plus, the company aggregates farm produce at DeHaat Collection Centres for processors, exporters, and large institutional buyers.

Self help groups (SHGs), farmer producer organisations (FPOs) and other ecosystem stakeholders can join the DeHaat marketplace on either end of the chain. Besides this, they can sign up to run DeHaat Centre in a franchise model.

DeHaat claims to solve the middleman problem in the agri-supply chain, but it essentially functions as a tech-enabled middleman to help retailers and ecommerce players – from Reliance Fresh to Zomato, Udaan to Safal – access fresh produce from farmers.

It earns a commission by bridging the gap between the two ends of the supply chain.

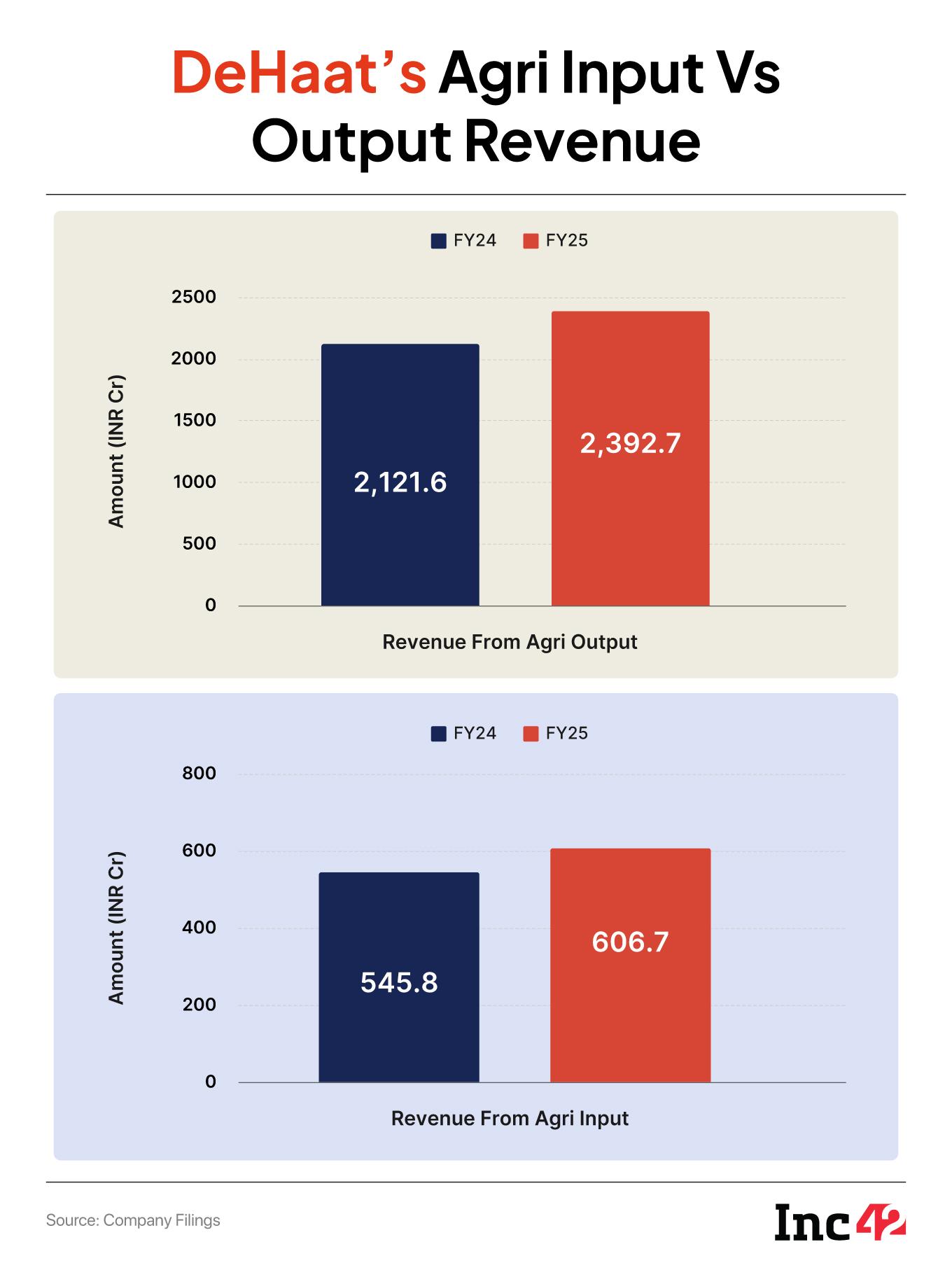

In FY25, INR 606.7 Cr came from input and service sales, while a majority of its revenue (INR 2,392.7 Cr) was driven by output linkages, signalling the company’s heavy reliance on trading margins from fresh produce aggregation.

The startup has partnered with the government’s ONDC to sell its white-labelled products. It is unclear how many product sales take place via this D2C model.

Besides the market linkage, the company’s app provides crop advisory services, soil testing, customised farm planning, access to crop insurance and more. While some of these services are free, the company charges farmers for services such as soil testing, customised farm planning, and pest management.

Despite having an extensive suite of services and products, DeHaat is not able to unlock the profits from the farmer base.

What’s Hindering Growth?Agritech experts say there are layered structural and policy challenges in India, which continue to impact most new-age agritech businesses, including DeHaat.

“In India’s agricultural sector, particularly on the output side, 94% comprises the informal sector, 4% is the traditional general or modern trade while another 2% comprises the quick commerce players. Newer agritech players operating in the output side are trying to serve this 2% and 4% market segment categories, but competing against an informal sector is extremely difficult,” said Venky Ramachandran, an agritech analyst and founder of Agribusiness Matters.

According to him, when a company is heavily dependent on the output side for generating revenue, it’s playing a difficult game with lower margins because it has to compete with the traders who are already more efficient and don’t have the overhead cost of running a company.

DeHaat is the case in point — the company is dependent on agricultural outputs for more than 79% of its revenue.

While the company has clearly been attempting to solve these problems in multiple ways — it acquired Freshtrop Fruits in 2023 to strengthen its export supply chain — the existing structural issues in agritech and the low margins are not easy problems to figure out.

DeHaat is more or less forced to balance this out by strengthening its input business. Growth on this front, however, is even more lacklustre, and following the recent changes in GST and disruption with D2C, more headwinds are expected.

DeHaat, AgroStar, BharatAgri and other startups are looking to build a new supply chain that eliminates the middle layer and reaches farmers directly. In this case, the startups are bearing the burden of distribution and last-mile delivery. And the high cost of this means retailers and farmers are both faced with a different kind of middle man than they are used to.

Retailers, too, are finding smarter ways to improve margins further by going direct to manufacturers. “Especially now, after the GST regime, the channel margins have come down in the input industry. There’s a lot of churn in the industry right now, corporate distribution models are emerging and newer distribution and franchise models are being experimented,” Ramachandran claimed.

Agritech Caught In A QuagmireCapital needs and discounts are a big concern in the agri supply chain and market linkage space, especially because farmers don’t trust new-age platforms easily.

Sachin Nandwana, cofounder and director of BigHaat, another market linkage startup, told Inc42 that his startup consciously chose to build relationships organically thanks to limited access to capital. And one way is transparency and trust.

“If there are 140 Mn farmers, engaging meaningfully with even 2% or 3% on a monthly basis is a great achievement. If an INR 100 product sells at more than INR 120 in the market and we can bring transparency to offer it at a fair price of INR 110, we create both savings and trust among farmers.”

Nandwana added that manufacturers retain 50%-70% margins, but when startups focus on building the ecosystem, the economics are very different — it requires efficient use of resources and strong operational discipline.

Having raised around $25 Mn in total so far, the startup turned profitable at an EBITDA level in FY25 with revenue crossing INR 1,100 Cr. Inc42 could not verify Nandwana’s claims independently.

On the other end of the spectrum, WayCool — India’s only agritech unicorn and DeHaat’s competitor — is in deep trouble. WayCool has also reduced its workforce and has come under the radar for corporate governance lapses. The company has struggled to raise funding in the past and managed to get a debt infusion of $4.4 Mn earlier this year.

The Way Ahead DeHaat & CoInc42 data shows that funding in agritech has remained muted in 2025 at around $160 Mn as of October 2025, compared to 2024, when more than $360 Mn was poured into Indian agri startups. This has also made scaling up a bit challenging for players that don’t have healthy cash flow.

To get to profitability and set the agritech benchmark, DeHaat plans to expand its existing distribution channels, product portfolio, and geographical presence.

In fact, the startup raised INR 200 Cr in venture debt from Trifecta Capital earlier this year for geographical expansion. The company did not share further information about its geographical expansion plans, but it’s foraying into exports and processed food categories such as frozen peas, fruit pulp, and purees.

Gaurav Bagrodia, president of SaralSCF, the supply chain finance arm of BlackSoil that has a supply-chain finance partnership with DeHaat, believes the startup’s strength lies in its integration of every key component – from agri-input supply and crop advisory to market linkages and financial enablement – into a single, cohesive ecosystem.

Bagrodia sees its last-mile network of DeHaat Centres as a key to establishing credibility at the grassroots level. Additionally, it is important to note that DeHaat has also started building its own private label portfolio.

“While profitability remains a challenge, the industry is gradually moving from transaction-led to infrastructure- and technology-led models,” he claimed.

According to him, post-harvest infrastructure, namely cold chains, packhouses, and processing, where India currently loses 20–30% of produce between farm and fork, can be an area of focus for startups.

Ramachandran believes agritech startups have to choose two from scale, technology and impact. “Cracking all three aspects has been almost impossible so far.

Agritech players like DeHaat have not chosen impact as a pillar yet, preferring to stick to scale and technology — areas that startups are more familiar with.

DeHaat and others of its kind wanted to replace the middleman, but the problem hasn’t disappeared; it has merely become tech-enabled, while the deeper issues around farmers’ access to credit and fair pricing remain unresolved.

The impact has been minimal, yet the opportunity is there. Digital infrastructure is expanding, drones and AI are transforming crop monitoring and spraying, and precision farming is no longer a distant dream.

Technology is seen as a way to build resilience against climate change, but startups will also have to rethink the agri supply chain in a world that’s getting warmer and warmer.

DeHaat focussed on solving the unit economics of farmers, but the future could require a different kind of approach to agritech. Which is why it’s imperative that the likes of DeHaat shore up their existing verticals and extract profitability that can help them solve the bigger challenges.

[Edited by Nikhil Subramaniam]

The post Inside DeHaat’s INR 3,000 Cr Scale And Its Long Road To Profitability appeared first on Inc42 Media.

You may also like

All eligible persons should get chance to vote: Kerala Governor urges Electoral officers

MPCB And BMC Crack Down On RMC Plants Breaching Pollution Norms, Developers Told To Relocate Units Occupying Over 70% Of Construction Sites

Indian Air Force gears up for grand flying display over Guwahati

'Relationship is very bad' – Arsenal's Martin Zubimendi at the centre of heated spat

NBA legend Paul Pierce finds himself in unexpected twist as he now hires chauffeur after late-night trouble