Kinara Capital is in a fix. For the first time in a decade, the Bengaluru-based NBFC incurred a loss in FY25, and credit rating agencies have downgraded the company amid concerns over its financial stability. So, how exactly did Kinara reach this tipping point?

From Profits To Peril: Kinara’s bleak predicament is partly due to a rise in bad loans, difficulties in recovering unsecured loans, higher credit costs, and a decline in assets under management (AUM).

Then, there were headwinds such as regulatory crackdown, macroeconomic conditions, sector-specific stress and increased customer overleveraging. This resulted in Kinara recording a net loss of INR 351 Cr in FY25 against a profit of INR 62 Cr in FY24.

The Making Of A Crisis: Kinara’s loss-making FY25 was a result of a multitude of factors, which have been bubbling for some years now:

- First, mounting write-offs for the last few years (INR 341 Cr in FY25, INR 123 Cr in FY24 and INR 74 Cr in FY23)

- Kinara’s cost on credit shot up to 14.5% in FY25 from 7.1% in the previous year

- A 9.6% YoY decline in AUM to INR 2,841 Cr in FY25, as it took a more cautious approach in disbursing credit to rein in piling bad loans

Lenders Loom Heavily: As profitability falters, creditors are breathing down the company’s neck. In the “continued breach” of 91.07% of financial covenants, pertaining to borrowings totalling INR 1,850 Cr, the company will have to repay this amount whenever lenders demand.

Despite the management’s efforts, waivers have been secured for only 4% of the impacted debt, leaving a substantial 87% of the borrowings in breach without lender forbearance. Failure to score further waivers could exert significant pressure on the liquidity profile and overall financial stability of the NBFC.

With investors hesitant and the prospect of raising INR 200 Cr to INR 300 Cr bleak, here’s how Kinara Capital’s story is unfolding.

From The Editor’s DeskInfra.Market Goes Shopping: The building materials platform has picked up a majority stake in tiles manufacturing company, Metro Group, in a share swap deal worth INR 200 Cr. With this, Infra.Market intends to strengthen its foothold in the tiles industry.

WeWork India’s IPO Back On Track: More than three months after SEBI kept the coworking startup’s DRHP in abeyance over certain disclosures, the regulator has reinstated WeWork India’s IPO bid. SEBI is currently processing the coworking major’s draft IPO papers.

Apollo Acquires Onco: The hospital chain acquired the troubled cancer care startup in December 2024 for an undisclosed amount. This comes days after OkCredit CEO Harsh Pokharna said that the healthtech startup had shut down.

Blinkit, Instamart Emerge Q1 Winners: The two quick commerce majors gained market share in Q1 FY26, as per a report by ICICI Securities. While the Eternal-owned company’s gross order value grew over 25% sequentially, Swiggy’s Instamart witnessed a 22% QoQ growth.

UPI’s Latest Tryst: The NPCI is working on an internet of things (IoT) version of the Unified Payments Interface, which will allow users to make digital payments via devices such as wearables and connected cars.

Kedaara To Acquire A Stake In Porter: The CCI has approved the PE firm’s proposal to invest in the hyperlocal logistics startup. This follows Porter closing a $200 Mn Series F round in May, which was co-led by Kedaara and Wellington Management.

BlackBuck Gets Tax Notice: The listed logistics startup received a tax demand notice of INR 28.55 Lakh from the I-T department. The notice was issued for failure to deduct tax on certain expenses, which were eligible for TDS. BlackBuck plans to appeal the order.

VerSe’s AI Reset: Once valued at a staggering $5 Bn, VerSe has been grappling with the rise of AI, declining revenues, mounting losses, alleged weaknesses in internal controls, tumbling valuations, and the list goes on. Can AI fix its problems?

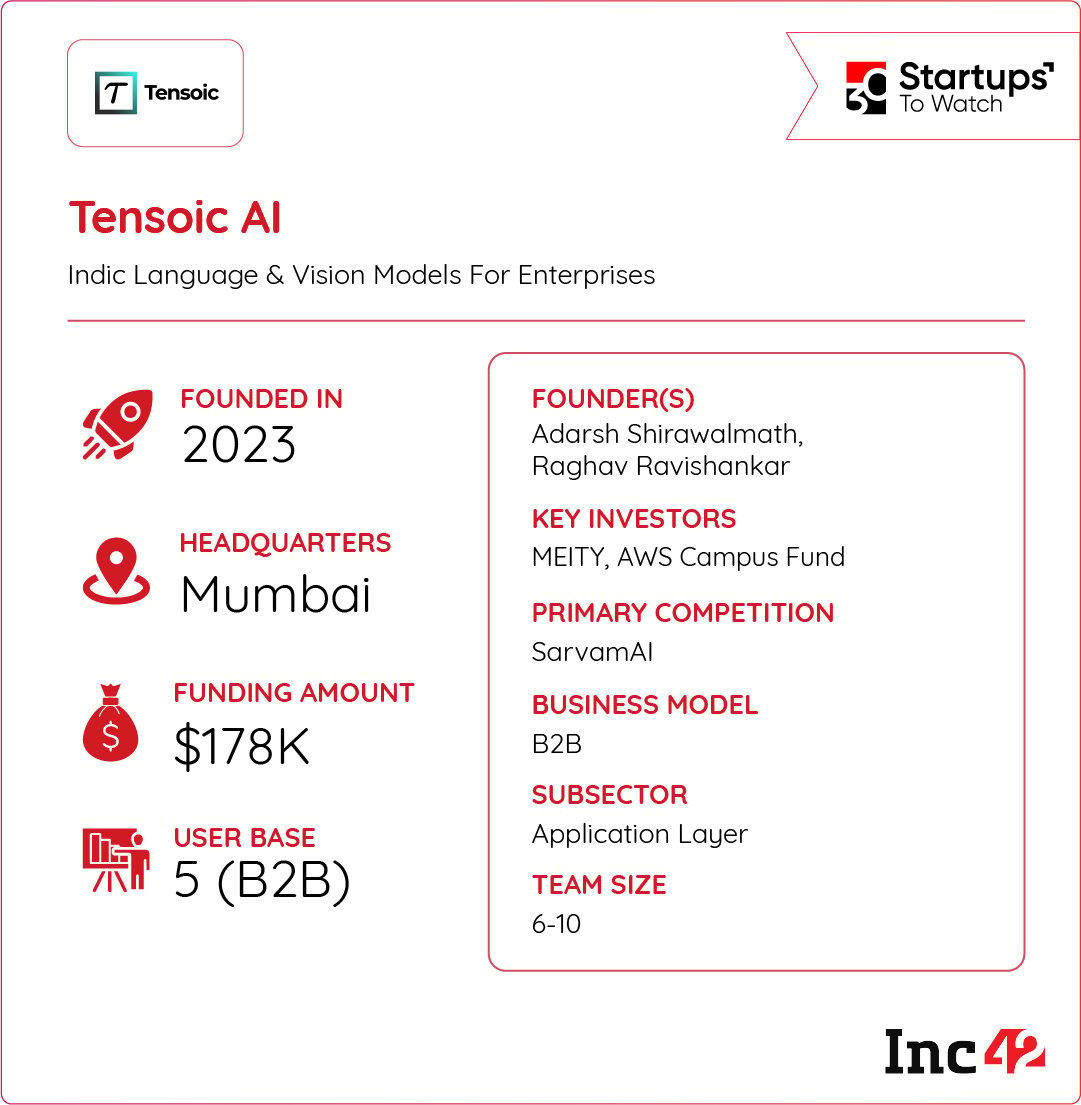

Inc42 Startup Spotlight How Tensoic AI Is Helping Enterprises Ride The AI WaveAs the GenAI wave sweeps the country, more and more enterprises want to leverage the emerging technology to automate their operations. To cater to this burgeoning demand, Adarsh Shirawalmath and Raghav Ravishankar founded Tensoic AI in 2023.

The Indic LLM Pitch: Tensoic AI specialises in fine‑tuning and deploying LLMs, multimodal vision‑language inference stacks, research and tooling around synthetic data, domain‑specific LLMs as well as text-to-speech models.

Blending open‑source community contributions with enterprise deployments, the Mumbai-based startup’s flagship product, Kannada LLaMA, is a 7 Bn LLaMA‑2 fine‑tuned model.

The Growing Reach: The startup claims that its fine-tuned model has been publicly tested by about 90K participants on Microsoft’s Pariksha platform. Besides, the startup has launched a Cerule vision‑language model. Overall, the startup is looking to capitalise on India’s growing GenAI market, which is projected to become a $17 Bn opportunity by 2030.

As GenAI becomes the norm, can Tensoic AI spur the adoption of Indic AI and vision models among enterprises?

The post Kinara Capital’s Fall From Profits, Infra.Market Goes Shopping & More appeared first on Inc42 Media.

You may also like

Delhi-NCR hit by sudden downpour, waterlogging triggers traffic chaos

HS2 chief admits £80bn project up to three years behind schedule

R.G. Kar rape-murder case: Convict Sanjay Roy approaches Calcutta HC challenging life imprisonment order by trial court

Weather expert names exact temperature 'most Brits' find too hot - and we're well above it

Ravi Shankar Prasad slams opposition over Bihar bandh, alleges pressure tactics on judiciary