What a week for India’s gaming industry! From ‘fun’ to ‘fraud’ and even ‘financing of terrorism’ — real money gaming (RMG) has hit its rock bottom.

The government looks determined to pull the plug on money-based online gaming, sending shockwaves across the ecosystem and sparking massive outcry from startups, investors, and users alike.

Naturally, there has been an outcry from the industry. In fact, the immediate fallout was dramatic — major players like Dream11, MPL, Probo, Zupee, PokerBaazi, and My11Circle announced shutting down all real money game offerings, with many more expected to follow suit. Others, such as WinZO, have halted all impacted games and are paring down their platform.

While on one hand, there are questions raised on the broader impact of startups shutting down, including the lakhs of jobs at stake, there is also clear support towards the step, as many believe it was a full-fledged gambling economy running unregulated in the guise of gaming.

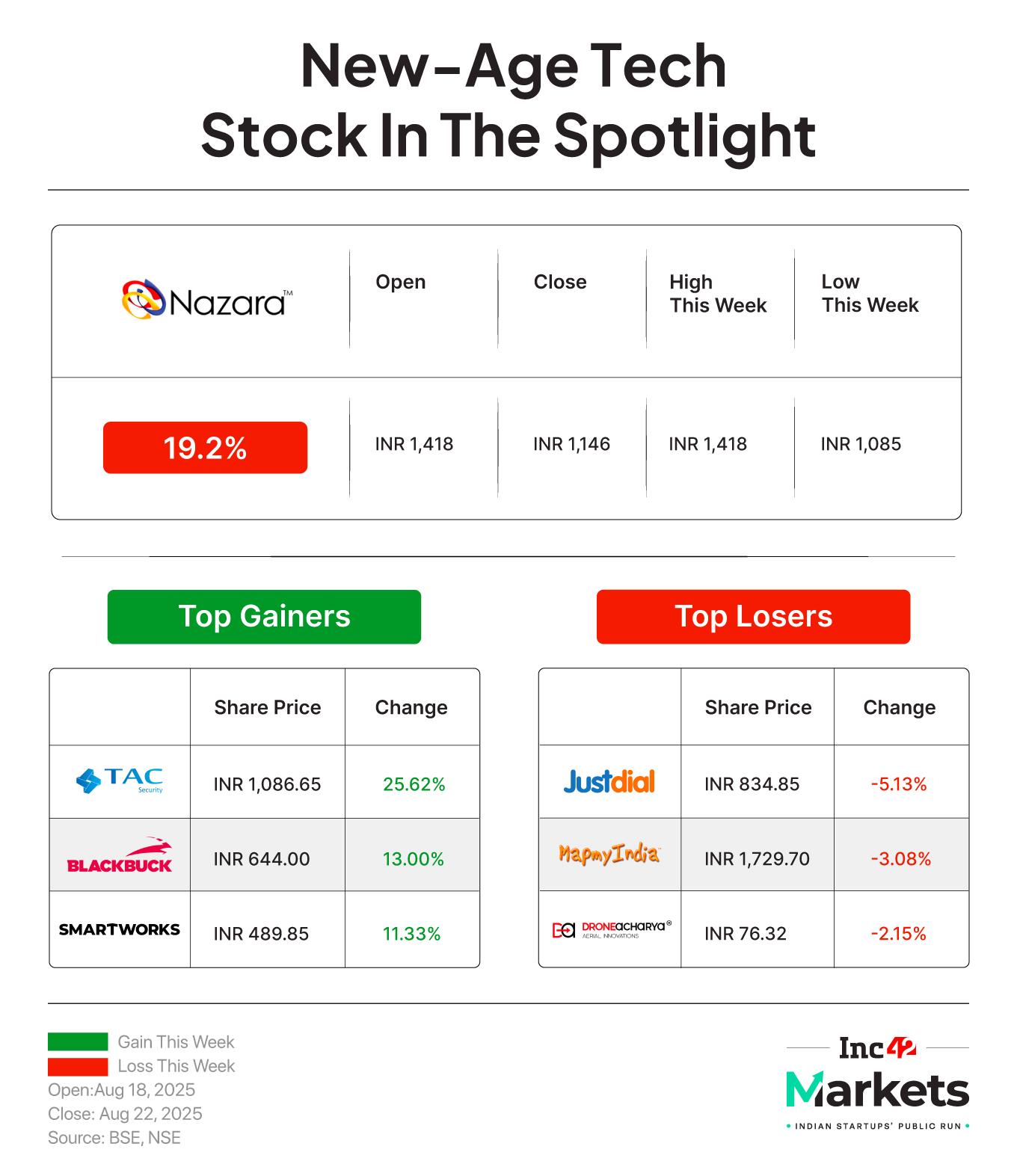

Amid all the hue and cry, Nazara Technologies’ fate and the sentiment of the public market seemed to have soured. The only listed online gaming major among the new-age companies, Nazara’s valuation was precisely at $1.5 Bn just last week and the share price has plunged by 19% this week.

Nazara was quick to put out its statement early morning on Wednesday (August 20), clarifying its exposure to RMG. “Nazara has no direct exposure to real money gaming (RMG) businesses.”

But the public market had already written its fate. Nazara’s stock crashed 13% to end the day’s trading at INR 1,221.65 on the BSE. It followed the losing streak in the next two sessions, with shares touching more than a three-month low spot at INR 1,155.75.

After seeing some pressure between September 2024 and April 2025, Nazara’s stock saw big gains earlier this year. But all of this was wiped out in a couple of sessions.

After months of slump, Nazara had started seeing an uptick in its stock movement from the end of May this year. Before the RMG ban, the shares had gained 40% year to date (YTD). Even now, the stock is up 14% YTD, which shows that Nazara had rallied significantly in the past few months.

Nazara’s investment, amounting to a total of INR 1,060 Cr, is now also in limbo. So it’s not just a major revenue opportunity that has been lost with Nazara potentially letting go of PokerBaazi.

Nazara’s RMG Play: A Narrow Escape?There are two critical questions from investors at this moment: How much exposure does Nazara have to RMG? And if there is no direct exposure, then why did the market dump the shares?

Nazara’s only exposure to RMG is through its 46.07% stake in Moonshine Technologies Private Limited or PokerBaazi. The rest of its gaming IPs, the segment which contributes a majority to its revenue, are casual games which are not impacted by the ban.

One year ago Nazara CEO and joint MD Nitish Mittersain told Inc42 that the company would not scale down its presence in RMG.

The founder’s stance was clear: it would now look into RMG “more positively and more closely” because of better regulatory and taxation clarity.

Although it’s a big question whether this gaming segment ever really had a proper regulatory clarity.

After all, this was the time when many RMG-focussed startups were cutting down their team sizes following the GST Council’s decision to levy 28% GST on money-based gaming.

But in any case, Nazara’s Mittersain was optimistic. Soon after, Nazara received shareholders’ approval to acquire a 47.7% stake in PokerBaazi parent Moonshine Technology, for a total deal value to INR 981.5 Cr.

Where Does Nazara Earn From?To be noted, Nazara still doesn’t hold a majority stake in the company, and hence, as the company stated, Moonshine’s revenue has not been consolidated in its financial statements. PokerBaazi is Nazara’s associate company, and not a core operating subsidiary.

In its latest earnings report for Q1 FY26, Nazara posted a net profit of INR 51.3 Cr, which saw over 117% year-on-year (YoY) jump and a massive 1,183% rise sequentially.

The company clocked an operating revenue of INR 498 Cr during the quarter, which doubled YoY. Sequentially, though, there was a slight decline.

And if we analyse the details, the biggest contributors to its growth were its expanding gaming vertical, which already includes its IPs such as Fusebox, Animal Jam, and Curve Games, and the adtech revenue.

However, had the RMG ban not happened, we cannot dismiss the possibility that Nazara would acquire a majority stake in it. In that case, it was indeed a huge revenue growth opportunity for the gaming major.

In its Q1 earnings report, Nazara disclosed that PokerBaazi parent Moonshine Technology’s net revenue grew 54% YoY to INR 191.8 Cr. The platform’s gross gaming revenue (GGR) grew 46% YoY to INR 434 Cr.

PokerBaazi also launched massive marketing campaigns during the IPL earlier this year, which gave a boost to its MAUs and DAUs, Nazara claimed.

As per its statement, INR 805 Cr has been spent towards equity shares in Moonshine through a combination of cash and stock, and it holds compulsory convertible shares amounting to INR 255 Cr.

“We will evaluate the potential impairment of our investment in Moonshine, but with our strong revenues, profitability, and cash flows, Nazara is well placed to absorb any impact with ease,” Mittersain’s post on X read.

The question is will the company write-off this investment or look to sell the stake to others? It’s unlikely that any investor would want to acquire the shares given the challenges in store for PokerBaazi.

Why Did The Public Market Dump Shares?Despite the company’s insistence, the market has its doubts about Nazara’s exposure to PokerBaazi. Cutting its rating to ‘reduce’ from ‘add’, ICICI Securities deemed it a “meaningful” exposure. The brokerage sees upside risks to the stock following a potential stake dilution by Nazara.

Meanwhile, the brokerage also said that a formal recognition of esports as a sport could be a structural positive for Nodwin Gaming. However, Nodwin ceased to be a subsidiary of the company after Nazara stepped away from the Nodwin board as announced in the Q1 FY26 disclosures.

Mittersain believes the strong support for esports, social gaming, and casual gaming positions Nazara to benefit from regulatory clarity and future growth in these segments.

Since RMG is not a major revenue driver for Nazara, its fundamental earnings outlook is not deeply impacted, but the sentiment risk is high.

“Investors often punish any perceived exposure to banned segments, and therefore, the stock could see short-term selling pressure and volatility,” Hariprasad K, research analyst and founder of Livelong Wealth, told us, adding, “The main risk is valuation perception and investor concern over capital allocation.”

Among other listed gaming companies, Delta Corp, has declined more than 5% this week. But experts believe that diversification would help any impacted companies stage a comeback over time once the market digests the regulatory impact.

For now, broader sentiment seems to be driving Nazara’s stock story. With RMG exposure limited, the company may well ride out the storm on the back of esports, adtech, and casual gaming tailwinds. But the big question remains: will Nitish Mittersain’s optimism hold true? Will Nazara turn another disruption into an opportunity?

Markets Watch: New Listings, Deals & More- Ola Electric’s IPO Fund Rejig: The EV maker received shareholders’ aprroval to alter the use of INR 5,500 Cr it raised from its IPO last year

- Table Space Coverts To Public Entity: The coworking space changed its legal name to Tablespace Technologies Limited, starts IPO preparations

- Kissht Files DRHP: The lending tech startup floated its draft red herring prospectus (DRHP) with SEBI to raise up to INR 1,000 Cr via the fresh issue. Its also has an offer-for-sale (OFS) of up to 88.8 Lakh shares

- Bluestone’s Lacklustre Debut: The jewellery startup got listing at a 1.5% discount to its issue price of INR 517 apiece on the BSE

- Captain Fresh Takes The Confidential Route: The seafood platform pre-filed its DRHP via the confidential route for a $400 Mn (about INR 3,400 Cr) IPO

[Edited by Nikhil Subramaniam]

The post Nazara’s INR 1,000 Cr RMG Question appeared first on Inc42 Media.

You may also like

Indonesia boat race: 11-year-old's viral dance turns festival into big tourist attraction; 1.5 million spectators expected this year

Abhishek Banerjee in Calcutta HC, files counter affidavit to plea challenging his 2024 LS win

Poor maths and English GCSE results don't add up to a prosperous future for the UK

ADGP M.R. Ajith Kumar moves Kerala HC against Vigilance report amid rising political heat

'I tried a gadget that pours pub-quality pints at home and it's perfect for BBQs'